Amid the Chip Shortage Crisis: YTMicro's First Domestic Automotive-grade MCU is Launched!

Amid the Chip Shortage Crisis: YTMicro's First Domestic Automotive-grade MCU is Launched!

Recently, Jiangsu Yuntu Microelectronics Co., Ltd. (YTMicro for short) confirmed that its first automotive-grade MCU has completed testing, with its functionality meeting design specifications and performance meeting expected standards. The company's core team boasts nearly 20 years of experience in automotive-grade chip development, having successfully developed and mass-produced several automotive-grade MCUs.

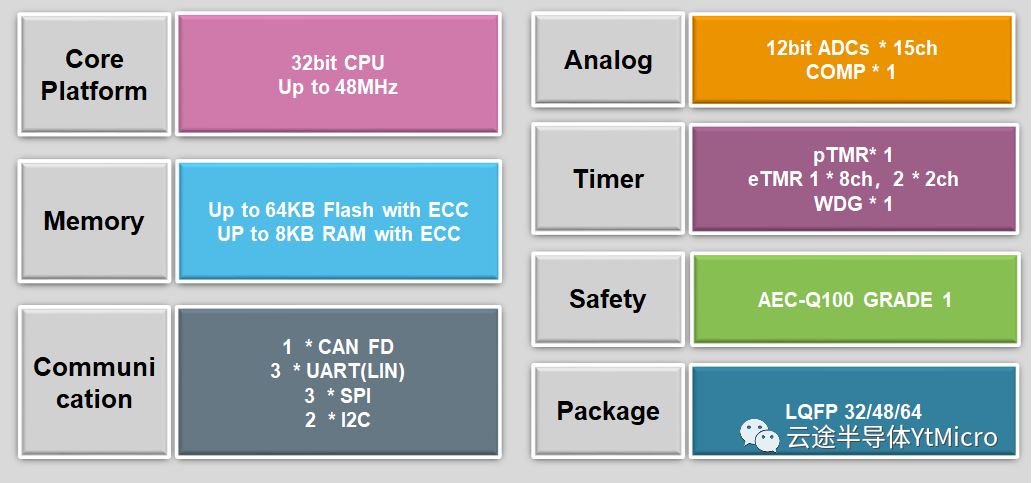

The newly launched automotive-grade MCU belongs to the YT32B1L series. It is an entry-level 32-bit product developed by YTMicro for the automotive body control field. With a maximum clock frequency of 48MHz, it features 128KB of Flash and 16KB of RAM, and is equipped with a range of interfaces including CAN-FD and LIN. Designed in accordance with automotive reliability standards (AEC-Q100), it is primarily used in applications such as sensor control, body motors, tire pressure monitoring, seats, power tailgates, sunroofs, lighting control, and interior lighting control. It can fully replace similar products from major international manufacturers in this series.

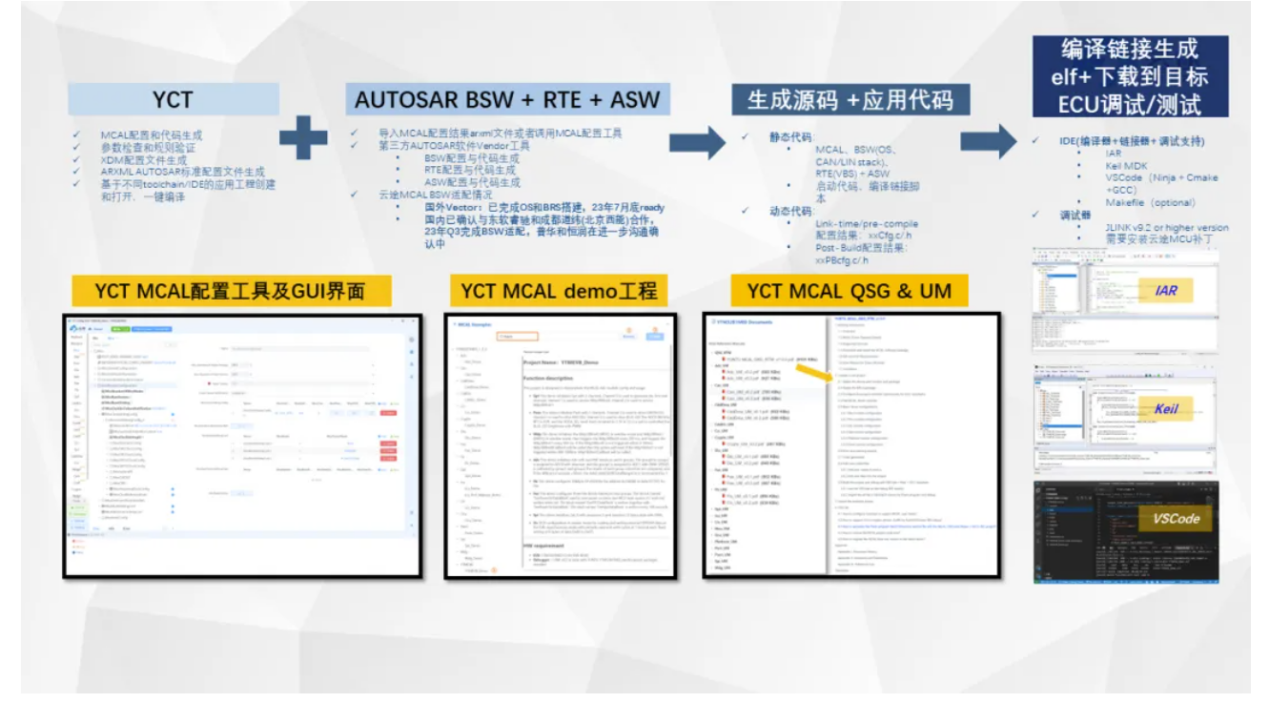

The YTM32L series will offer an SDK package that meets automotive-grade requirements, along with various reference designs. Customers only need to focus on application layer development, minimizing platform porting costs and risks to the greatest extent.

How serious is the global automotive "chip shortage"?

Due to the shortage, in the first quarter of this year, the delivery of 1 million cars worldwide was delayed. The global automotive industry's sales revenue in 2021 was reduced by as much as $60 billion. Many automakers were forced to halt production, and the impact of the "chip shortage" continues to expand. A majority of car manufacturers have reduced or stopped production due to the shortage.

Undoubtedly, the automotive industry is becoming the focal point of the tech sector. With companies like Huawei and Xiaomi entering the market and Tesla caught in the whirlwind of public opinion, intelligent vehicles have attracted widespread attention. On the other hand, since last year, there has been a severe shortage of MCUs, affecting almost all automakers worldwide. Companies such as Toyota, Ford, and Volkswagen have repeatedly halted production.

The shortage of chip production capacity has led to continuous price hikes.

STMicroelectronics has raised prices twice in the past six months, and other companies like NXP, Renesas, and Microchip have also announced price adjustments. Chips have become a major obstacle in the automotive industry supply chain, and automotive-grade MCUs within the MCU segment represent a significant challenge for China's domestic semiconductor industry.

How difficult is the development of automotive-grade MCUs?

From an application perspective, MCUs can be categorized into four main types: consumer-grade, industrial-grade, automotive-grade, and military-grade, with increasing technical difficulty and requirements at each level. Comparing automotive-grade MCUs with consumer-grade MCUs, automotive-grade MCUs have extremely stringent requirements in terms of product reliability, consistency, stability, and operating temperature range.

### Environmental Requirements

The first and foremost requirement is temperature: automotive electronics have a broader operating temperature range depending on the component’s installation location, but it generally exceeds the requirements for consumer products. For example:- Engine compartment: -40°C to 150°C, - Body control: -40°C to 125°C; In contrast, consumer products typically only need to meet a range of 0°C to 70°C. Additionally, other environmental requirements—such as humidity, mold, dust, water, EMC, and corrosion from harmful gases—are far more demanding than those for consumer electronics.

### Stability Requirements

Automobiles face more vibrations and shocks during operation compared to stationary consumer products. This means the stability requirements are significantly higher. Furthermore, the interference resistance required for automotive components is extremely high, including resistance to electrostatic discharge (ESD), electrical fast transients (EFT), burst pulses, and radiated emissions (RS). MCUs must be designed to withstand these interferences without damage, system crashes, or resets.

### Reliability Requirements

Reliability here encompasses two main aspects:

1. **Product Lifetime**: The expected service life of a car is generally 15 to 20 years, far exceeding the lifespan requirements of consumer electronics.

2. **Component Reliability**: Modern vehicles are highly electrified, with many electronic systems integrated into everything from the powertrain to the braking system. Each of these systems is composed of numerous electronic components. Ensuring overall vehicle reliability requires high standards for every individual component in the system.

### Consistency Requirements

Today’s automobiles are mass-produced, with some models reaching hundreds of thousands of units per year. This creates a very high demand for product consistency. For complex automotive products, any inconsistency in components that could lead to safety risks is absolutely unacceptable.

### Product Lifecycle Requirements

Although the price of automobiles has been steadily decreasing in recent years, cars are still durable, long-life products, with an expected usage cycle of over 15 years. As automotive parts suppliers, manufacturers must ensure long-term availability of spare parts. Additionally, developing a car component requires extensive validation, and any replacement parts must undergo a similar validation process. This means that automakers and component suppliers need to maintain stable supply chains over long periods.

AEC-Q100 is just the threshold for automotive-grade chips.

The most common testing standards for automotive electronic components are AEC-Q100 (001–012), AEC-Q101, and AEC-Q200. Among them, AEC-Q100 is the first standard established by AEC, first published in June 1994. After more than a decade of development, AEC-Q100 has become the universal standard for automotive electronic systems. For automotive chips, AEC-Q100 is also the most common stress test certification specification.

AEC-Q100’s reliability testing for ICs can be broken down into several categories, including accelerated environmental stress reliability, accelerated life-simulation reliability, packaging reliability, wafer-process reliability, electrical parameter verification, defect screening, and package integrity testing. Testing conditions must be selected based on the temperature levels that the device can withstand.

AEC-Q100 is a mandatory testing standard for all automotive-grade MCUs and represents the entry-level requirement for automotive-grade chips. However, automotive-grade MCUs are not limited to just AEC-Q100. As automobiles become increasingly intelligent and their electronic control systems grow more complex, the number of chips used in vehicles continues to rise. To mitigate the unreasonable risks caused by electrical or electronic system failures, functional safety in automotive-grade MCUs has become an emerging concern.

Functional Safety (ISO 26262) is the Core

ISO 26262 is the functional safety standard for electrical/electronic systems in automobiles. This standard was established in November 2011, with a second edition released in 2018, which included additional semiconductor guidelines.

The scope of ISO 26262 covers the entire vehicle development lifecycle, from the conceptualization of the vehicle to the development of systems, ECUs (Electronic Control Units), embedded software, components, and related processes such as production, maintenance, and decommissioning.

ISO 26262 certification is divided into two main categories: development process standards and product performance standards. The development process standards are based on the IATF 16949 standard, incorporating management aspects like traceability and documentation. The product performance standards are focused on meeting the safety levels required by ASIL (Automotive Safety Integrity Level), and may include features such as self-diagnosis.

Therefore, ISO 26262 is one of the key benchmarks for evaluating the stability and quality of automotive electronic components. The certification process, through its tiered requirements, ensures the implementation of effective improvements to maintain safety within acceptable tolerances.

There are two ways to obtain ISO 26262 certification: through third-party certification bodies or self-certification. Third-party certification bodies, such as TÜV Rheinland, TÜV SÜD, and SGS-TÜV, review and certify whether a semiconductor company has established processes that comply with ISO 26262 standards. After passing third-party audits, companies can obtain certification, advancing the development of automotive products that meet functional safety requirements. Currently, YTMicro has initiated the functional safety process certification and plans to release automotive-grade MCUs compliant with ISO 26262 ASIL-B level later this year.

Conclusion: As the automotive industry continues its shift towards greater intelligence, the shipment volume of automotive-grade MCUs (microcontroller units) is steadily increasing. According to IC Insights, the automotive MCU market is expected to approach 46 billion RMB in 2020, accounting for 40% of the overall MCU market. By 2025, it is projected to reach 70 billion RMB, with unit shipments growing at a compound annual growth rate (CAGR) of 11.1%.

However, from a global industry chain perspective, the MCU market is entirely dominated by foreign giants, while domestic manufacturers have only started relatively late and hold a market share close to zero. The escalation of the US-China trade conflict has exacerbated the "choke point" phenomenon in automotive MCU supply, with the ongoing shortage of automotive MCUs further intensifying the situation. This has led to a growing consensus within the industry that domestic substitution is an inevitable trend.

With the launch of YTMicro's first automotive-grade MCU, the YTM32B1L series, and the upcoming release of the high-end YTM32B1M series, which is expected to meet ISO 26262 ASIL-B requirements in August, YTMicro is poised to cover the entire body control application field within two years with its mass-produced products. Looking ahead, YTMicro will leverage its body MCU as a foundation to expand into domains such as domain controllers, in-vehicle gateways, and intelligent cockpits. By adopting an open and win-win business model, YTMicro will collaborate with customers and partners to accelerate the mass production and deployment of automotive-grade chips, ensuring supply chain security.

About YTMicro:

Jiangsu Yuntu Microelectronics Co., Ltd. (YTMicro for short) is a fabless semiconductor and integrated circuit design company specializing in automotive-grade chips. YTMicro is committed to providing comprehensive automotive chip solutions, ensuring the innovation of global intelligent mobility technologies.

Founded in July 2020, YTMicro is headquartered in Suzhou, with research and development centers and offices in Shanghai, Shenzhen, and other locations. Through dedicated efforts, YTMicro has established its own integrated circuit design and validation platform, developed development processes and standards, and successfully created multiple chips with independent intellectual property rights, filing several related patents. YTMicro has also formed strategic partnerships with industry leaders within the ecosystem, particularly in wafer manufacturing, packaging, and testing through a reliable supply chain.

YTMicro's mission is to provide customers with the highest quality solutions and services, offering timely responses to customer needs. Focused on customer satisfaction, YTMicro strives to create more value for its clients.

Company website: www.ytmicro.com