YTMicro Completes Its Fourth Round of Financing, Leading the Way in Mass Production and Shipment of Automotive-Grade Chips

On December 31, 2021, Jiangsu Yuntu Microelectronics Co., Ltd. (YTMicro for short) officially announced the completion of its Series A financing, raising hundreds of millions of RMB. Since its establishment, YTMicro has secured four rounds of funding in just 15 months. The Series A investors include Lianxin Capital, Inovance Technology, Linxin Investment, Hangzhou Jintou Industry, and existing shareholder Xiaomi Changjiang Fund, which also participated in this round of investment.

Through persistent effort, YTMicro has now outpaced other similar startups, becoming the first fabless company to achieve mass production of automotive-grade chips. The company has made significant breakthroughs in both research and development progress and product quality, officially entering a new era of mass production for automotive MCU chips. The funds raised in this round of financing will be used to further invest in the R&D and market promotion of automotive-grade chips, including functional safety ASIL-D level applications for automotive electric drive and domain controllers, as well as multi-core products. YTMicro is committed to becoming a leading enterprise in automotive-grade chips, ensuring the security of the automotive supply chain amid the global chip shortage crisis.

Filling the Domestic Gap

Leading the Way in Mass Production and Delivery of Automotive-Grade Chips

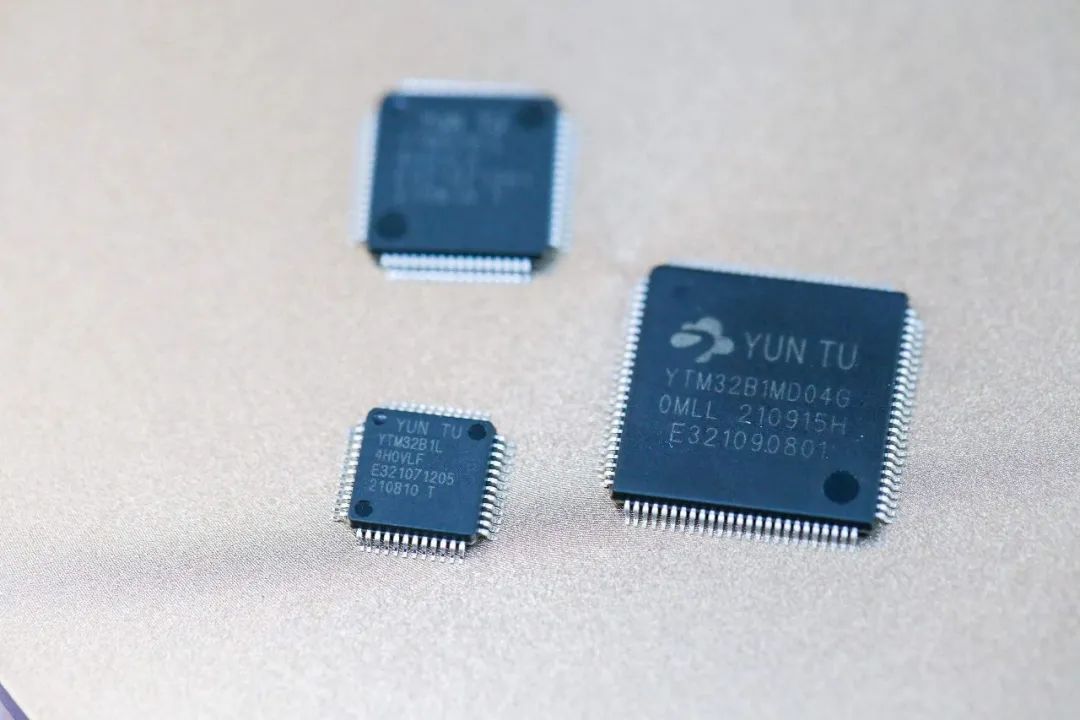

YTMicro was founded in July 2020 as a fabless automotive chip company. Its core technical team has nearly 20 years of experience in automotive-grade chip design. In just 15 months, the company completed the development and tape-out of four automotive-grade chips, demonstrating YTMicro's technical strength with high-quality products to automotive customers.

The first automotive-grade 32-bit MCU, the YTM32B1L series, has already entered mass production. It is primarily used in applications such as sensor control, EPS, T-Box, TPMS, seats, power tailgates, windows, and lighting control. This product has already secured orders from multiple component suppliers and has been successfully selected for several vehicle models.

YTMicro's Chairman, Wang Jianzhong, stated that since 2021, almost all automakers have been severely impacted by a significant issue — the shortage of "car chips." Without chips, vehicles cannot be produced. In the third-quarter financial reports released by several publicly listed automakers, most attributed their profit declines to the chip shortage. At the same time, the U.S. has continued to strengthen restrictions on China's electronic information industry, insisting on a hard decoupling, which has increased the risks to China's supply chain security. As a result, the need for domestic chip substitution has become urgent. Multiple market research institutions and leading global companies predict that the chip supply shortage will persist at least until the end of 2022, with some even suggesting that supply constraints may not ease until 2027. This external environment has created unprecedented opportunities for YTMicro.

Responding to the Automotive "Chip Shortage" Crisis

Steadily Advancing and Showcasing Strong Capabilities

In response to the global automotive "chip shortage" crisis, YTMicro is accelerating the mass production and deployment of its products through an open and win-win business model, steadily advancing and showcasing its strong capabilities.

YTMicro's CEO, Geng Xiaoxiang, stated that the company's strategic direction is clear: to become a leading domestic provider of automotive-grade chips and fill the market gap for domestically produced chips. YTMicro boasts a rare, top-tier chip development team with nearly 20 years of experience in automotive-grade chips. Leveraging its deep understanding and extensive experience in automotive semiconductor technology, YTMicro successfully launched products and achieved mass production in just one year. With strong support from national policies and capital, YTMicro has demonstrated its technical and market capabilities, aiming to become a high-end brand in China's automotive chip sector.

Currently, YTMicro is entering the body control MCU market, with plans for four product series—L, M, H, and Z—covering a total of 200 models. The company will gradually complete development and achieve mass production and delivery. The second product in development, the YTM32B1M series, which meets AEC-Q100 Grade 1 standards and complies with functional safety ISO 26262 at ASIL-B level, is expected to have engineering samples available in the first quarter of 2022, with mass production and shipments anticipated by June. The YTM32B1M series is a highly reliable, high-performance, high-safety, and high-consistency 32-bit automotive-grade MCU, which can be widely applied in fields such as EPS, BCM, T-box, VCU, DCU, and other automotive applications.

In 2022, YTMicro will provide complete solutions in areas such as domain controller gateways, electric drive and control, and BMS master control chips. Currently, in the domain controller gateway field, YTMicro is developing the YTM32H series chip, which supports Gigabit Ethernet, multiple CAN buses, and domain control-related functions. It is believed that in the near future, YTMicro is expected to become the domestic fabless company with the most comprehensive product lineup and the widest coverage in the automotive-grade chip sector.

Strong Investor Confidence

Structural Chip Shortage Sparks Wave of Domestic Automotive Chip Substitution

The investors in this round have expressed that the current "chip shortage" environment presents a historic opportunity for domestic automotive chip companies. As a result, they have shown an open attitude and are offering more collaboration opportunities to chip companies like YTMicro, which possess strong technical capabilities and high-quality products. With its top-tier technical team and robust product strength, it is believed that YTMicro will lead this specialized field in the future and become one of the top domestic automotive chip companies.

About Lianxin Capital

Founded in 2008, Lianxin Capital is a fund management company focused on private equity and venture capital. The firm manages multiple funds with total assets exceeding 13 billion RMB. Its main investors include well-known state-owned enterprise groups, professional fund-of-funds, government-guided funds, and listed companies.

Lianxin Capital primarily invests in sectors such as TMT (Technology, Media, and Telecom) and healthcare, covering early-stage, growth-stage, and mature-stage investments. To date, the firm has completed nearly 100 investments, with nearly 30 of them successfully listed or registered for IPOs both domestically and internationally, nurturing a number of industry leaders.

About Inovance Technology

Inovance Technology Co., Ltd. (referred to as "Inovance") was founded in 2003, focusing on automation, digitalization, and intelligence in the industrial sector. The company specializes in core technologies across the "Information Layer, Control Layer, Drive Layer, Execution Layer, and Sensing Layer," and is dedicated to the research, development, production, and sales of industrial automation control products. Positioned to serve high-end equipment manufacturers, Inovance leverages its proprietary industrial automation control technologies to quickly provide personalized solutions to customers. The company is committed to advancing industrial civilization with leading technologies and delivering smarter, more precise, and cutting-edge products and solutions. Inovance is a leader in the domestic industrial automation control field and a publicly listed company. The company has over 20 subsidiaries, including in Suzhou, Hangzhou, Nanjing, Shanghai, Ningbo, Changchun, and Hong Kong. It employs more than 14,000 people, including a research and development team of over 2,800 professionals dedicated to core platform technology research, application technology, and product development, with R&D investment reaching 1.12 billion RMB.In December 2020, Inovance was included in the "2020 Hurun China Top 500 Private Enterprises," ranking 93rd.

About Linxin Investment

Linxin Investment was established in May 2015 in Lingang, Shanghai, and is one of the earliest investment institutions in China to focus on overseas mergers and acquisitions in the integrated circuit (IC) field. Its investment team has initiated and led well-known domestic M&A projects, including those with companies such as Lanqi Technology and OmniVision Technologies. Notably, Lanqi Technology (688008) and Zhongwei Company (688012), key investments, became among the first integrated circuit companies listed on the Shanghai Star Market (STAR Market) in July 2019, both surpassing a market value of 100 billion RMB.

As a domestic investment platform focused on the integrated circuit industry, Linxin Investment relies on a specialized investment and management team with an all-industry background. It collaborates with leading industry enterprises, investment institutions, and local governments to conduct global integrated circuit industry investments. The goal is to create exceptional value for investors, enterprises, and society, while actively promoting the healthy development of China's integrated circuit industry.

About Hangzhou Jin Tou Industry

Hangzhou Jin Tou Industry is a professional investment platform responsible for industrial investment and financing under the Hangzhou Financial Investment Group, with a management scale of nearly 10 billion RMB. The company primarily focuses on sectors such as hard technology, advanced manufacturing, information economy, healthcare, new materials, and new energy. It utilizes a variety of investment methods, including fund-of-funds, equity funds, specialized funds, mezzanine investments, merger and acquisition funds, and investment consulting, to provide comprehensive financial services to leading enterprises and publicly listed companies in the real economy. The company has initiated or participated in the establishment of over 60 funds, with direct or indirect investments in more than 1,000 projects, over 100 of which have been listed.